Where are investors placing their bets next year? AI, AI, AI.

Investors at TechCrunch Disrupt did not shy away from admitting they are interested in mainly one thing: artificial intelligence.

Investors at TechCrunch Disrupt did not shy away from admitting they are interested in mainly one thing: artificial intelligence.

Investors at TechCrunch Disrupt made one thing very clear: artificial intelligence is dominating venture capital attention. Leading VCs Nina Achadjian of Index Ventures, Jerry Chen of Greylock, and Peter Deng of Felicis spoke candidly about what excites them, what worries them, and how AI startups can stand out in an increasingly crowded market.

According to Achadjian, the pace of change in AI is unlike anything investors have seen before, with startups scaling at unprecedented speed.

“We spend an enormous amount of time assessing the entrepreneur and how resilient they will be in a moment where things are rapidly changing,”

ΓÇö Nina Achadjian, Index Ventures

Achadjian emphasized that passion, domain expertise, and honesty about product-market fit are now critical for founders pitching AI startups.

While enterprise customers are eager to experiment with the latest AI tools, she warned that this enthusiasm can create false signals of success.

“There is so much demand from enterprise companies to try the latest and greatest AIΓǪ you can get a lot of revenue without having true ROI,” she said.

In other words, early revenue does not always mean customers are getting long-term valueΓÇösomething investors are scrutinizing closely.

Another key trait investors look for is adaptability. As AI markets evolve rapidly, founders must be prepared to pivot when assumptions break.

“There’s a joke that, like, 1,000 startups dieΓÇöand that’s why being resilient is really important,” Achadjian added.

With competition intensifying daily, flexibility may be the difference between scaling and shutting down.

Peter Deng, a former OpenAI executive, stressed that founders must identify unique data advantages that competitors can’t easily replicate.

Enterprise customers often test multiple AI vendors at the same time, Deng noted. What separates winners is the ability to solve a problem deeply and uniquely.

“If you’re able to go deep and really solve a true need for themΓÇöin a way they cannot do themselvesΓÇödata management becomes the most important part.”

Achadjian echoed this sentiment, adding that founders must explain why their product won’t simply become a feature inside a foundational model. Even if they don’t know what large AI labs are building, investors expect a defensible hypothesis.

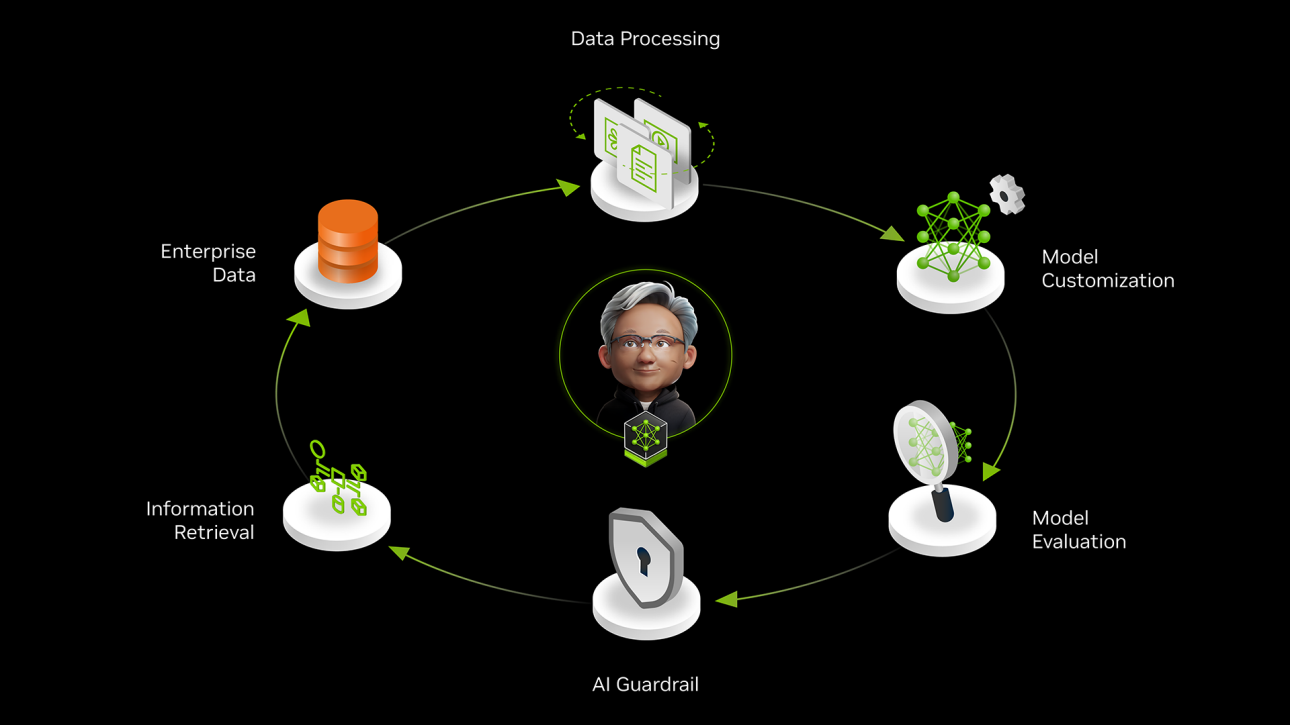

Jerry Chen highlighted three AI categories currently showing strong traction:

However, he emphasized that AI’s impact is still in its early stages across many industries.

)

Looking ahead, each investor expressed optimism about different areas:

Interestingly, Achadjian also pointed out that many industries still rely on pen-and-paper workflows, particularly in blue-collar sectors.

“There’s a lot of opportunity there,” she saidΓÇöacknowledging that even these manual processes are prime candidates for AI-driven automation.

At TechCrunch Disrupt, the message from investors was unmistakable: AI is not just a trendΓÇöit’s the core focus of venture capital today. But in a market flooded with similar pitches, startups must prove resilience, defensibility, real ROI, and a deep understanding of their customers to stand out.

For founders, the bar has never been higherΓÇöand the opportunity has never been bigger.

What sector are investors most bullish on next year?

Artificial Intelligence (AI) remains the top investment focus for global investors.

Why is AI attracting so much investor interest?

AI is driving productivity, automation, and innovation across industries, offering strong long-term growth potential.

Which areas of AI are investors targeting?

Key areas include generative AI, agentic AI, AI infrastructure, chips, cloud computing, and data centers.

Are investors focusing only on AI software companies?

No. Investors are also betting heavily on AI hardware, semiconductors, cloud platforms, and AI-powered services.

Is venture capital also prioritizing AI startups?

Yes. Venture capital funding is increasingly flowing into AI startups, especially in automation, enterprise AI, and industry-specific solutions.

Are public markets benefiting from the AI trend?

Yes. AI-focused stocks and ETFs continue to attract strong inflows from institutional and retail investors.

Are there risks in AI-heavy investments?

Yes. Valuation concerns, regulation, and intense competition are key risks, but long-term confidence remains strong.

Will AI remain dominant beyond next year?

Most analysts believe AI will continue to be a major investment theme for the next decade.